Frequently Asked Questions

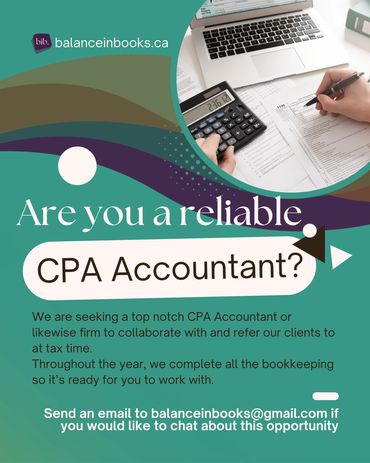

Please reach us at balanceinbooks@gmail.com if you cannot find an answer to your question.

QBO and Xero! If you started with another software, we will migrate you over upon engagement. Specializing in these two software's makes us super efficient. Rather than working with 10 different ones.

A bookkeeper focuses on the day-to-day management of financial transactions. They record income and expenses, manage invoices, reconcile bank accounts, and ensure the financial data is accurate and organized. Bookkeepers maintain the foundation of financial records that businesses rely on.

An accountant takes a broader view. They prepare financial statements, and assist with tax planning and filing. Accountants often interpret the records bookkeepers maintain and offer advice to help businesses make informed decisions.

Both roles are essential for a business’s financial health!

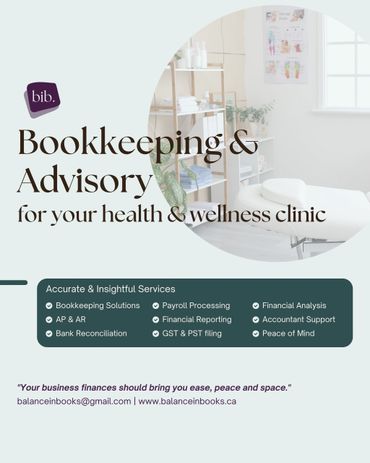

We are supporting growing Canadian small businesses who want to have clarity around their numbers. We also have a health and wellness sector of the business, but we are here for all our small business owners!

Yes, all of our work is remote! If we have the pleasure of being in close geographical proximity, we are always up for in person meetings too.

First we have a discovery call to understand how we can best support you and your bookkeeping, we make an agreement outlining services and expectations on both sides. Then we go through onboarding, which is sharing delegate access to your sales channels, bank and credit card statements and tax filing portals.

Next is bookkeeping completed monthly with reports and if you've chosen a strategy package then we get into the nitty gritty!

Every organization operates differently, which is beautiful. It has unique goals, structures, and financial activities. Factors like industry, business size, revenue streams, and compliance requirements all influence accounting needs.

For example, a retail business might require detailed inventory tracking, while a service-based business focuses on invoicing and time tracking. Nonprofits have specific reporting requirements for grants and donations, whereas startups may prioritize cash flow management and investor reporting.

Tailoring accounting services to fit these needs ensures accuracy, efficiency, and compliance, while also providing insights that align with each organization’s goals. One-size-fits-all solutions simply don’t meet the demands of diverse businesses, so we specialize in our industry to really hone in on the needs of our clients.

.png/:/cr=t:0%25,l:0%25,w:100%25,h:100%25/rs=w:370,cg:true)

.png/:/cr=t:0%25,l:0%25,w:100%25,h:100%25/rs=w:370,cg:true)

Bookkeeping + Systems

Bookkeeping + Systems

Bookkeeping + Systems

Our bookkeeping services ensure your financial records are accurate and up-to-date. We use the latest software and technology to handle all your bookkeeping needs, so you can focus on growing your business.

Advisory + Consulting

Bookkeeping + Systems

Bookkeeping + Systems

Our advisory services help you improve your business operations and increase profitability. We offer customized solutions tailored to your specific business needs.

Payroll Management

Bookkeeping + Systems

Payroll Management

Our payroll processing services help you save time and money by handling all aspects of payroll management. From calculating employee wages to filing payroll taxes, we've got you covered.

This website uses cookies.

We use cookies to analyze website traffic and optimize your website experience.